Mark Chilvers / Oxfam

Who wants to be a trillionaire? Why extreme wealth matters for all of us

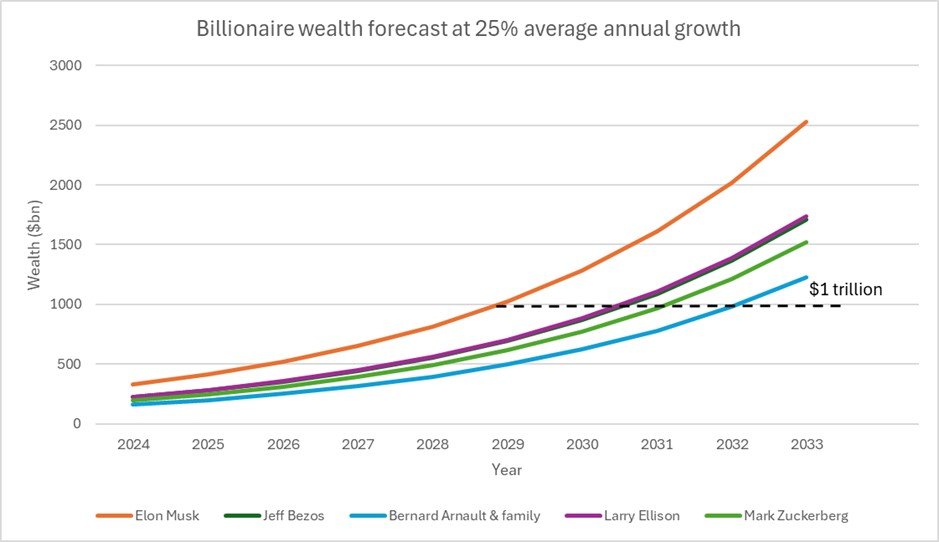

What does it mean when five men could become trillionaires? Oxfam's research, published to coincide with Davos 2025, reveals the shocking pace of wealth inequality — and what we can do to stop it.

A game show we never signed up for

Getting to five trillionaires within a decade

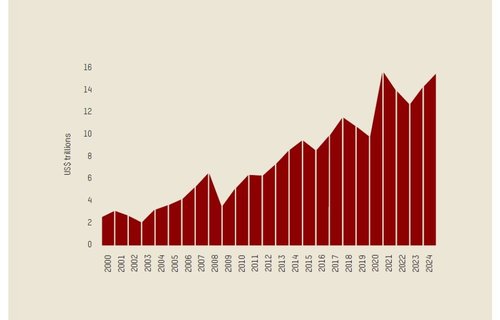

We've been keeping a close eye on how billionaire wealth has evolved since 2014 when Oxfam calculated that the 85 richest people owned as much wealth as half the world.

How did we calculate trillionaire wealth?

"Takers not makers" methodology note

Different methods deliver the same results

Could there be a trillionaire sooner?

The hidden cost of extreme wealth

What can we do to tackle extreme wealth?

“Change happens when people speak up. Every voice matters — including yours”

Alex Maitland, Inequality Policy Adviser, Oxfam International

A future worth fighting for

Sources

More posts like this

We live in a world where there is enough wealth to tackle the biggest global challenges like poverty and the climate crisis, if only the wealth was distributed fairly.

– In response to recent claims about Scotland’s tax system, Oxfam Scotland’s Jamie Livingstone wrote to The Scotsman to explain why political leaders both sides of the border should focus on better taxing wealth.